owner's draw vs salary uk

At year-end credit the Owners Drawing account to close it for the year and transfer the balance with a debit to the Owners Equity account. Take into account any salary already earned from a previous job if applicable when working out how much further salary you wish to draw down in the current tax year.

Business Operations Archives Leadership Girl Business Owner Business Operations Management

If you want to take a draw from a C-corp the better option may be to take it in the form of a bonus.

. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility. For example if you invested 50000 into your business entity and your share of the profit is 25000 then your owners equity is at 75000.

A draw. Draws can happen at regular. Wages and salaries are weekly and monthly payments made from a company to the employee.

Owners equity refers to your share of your business assets like your initial investment and any profits your business has made. So to break it down again. If youre a sole proprietor business owner or a partner or an LLC being taxed like one of these taking an owners draw is the easiest.

Owners Draw vs. The business owner takes funds out of the business for personal use. If a salesperson receives a base salary of 60000 their target annual.

A salary is a set amount that is paid to an employee or business owner on a regular basis with a paycheck that includes payroll tax withholdings. If you own a company of your own you can register as an employer and pay yourself a wage. Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use.

There are two journal entries for Owners Drawing account. 70000 contributions 30000 share of profits 15000 owners draw 85000 partner equity balance. Owners equity is made up of any funds that have been invested in the business the individuals share of any profit as well as any deductions that have been made out of the account.

Owners draws are usually taken from your owners equity account. On the other hand owners of corporations or S-corporations generally cant take a draw and would. When you do business in your own name as a sole proprietorship there isnt really such a thing as a salary or a distribution.

At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. If youre not interested in the bonus route you can always adjust your salary each year based on how your company is performing. Business owners might use a draw for compensation versus paying themselves a salary.

This is because the owners. February 4 2022. The business owner takes funds out of the business for personal use.

Wages are seen as an allowable business expense and are tax-deductible. Likewise if youre an owner of a sole proprietorship youre considered self-employed so you wouldnt be paid a salary but instead take an owners draw. Salary method vs.

Draws can happen at regular intervals or when needed. Clients and customers pay you you pay taxes done and done. Generally the salary option is recommended for the owners of C corps and S corps while taking an owners draw is usually a better option for LLC owners sole proprietorships and partnerships.

Business owners can receive either a salary or a draw from their businesses depending on the structure expenses profits and reasonable compensation guidelines for their geographic area. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. Wages can only be paid by registered companies and employers.

The draw method and the salary method. So if your company grew by 50 in the past year and your current salary is 70000 youd multiply your salary by 150 and come up with your new salary which is 105000 not bad. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. Single-member LLC owners are also considered sole proprietors for tax purposes so they would take a draw. Understand the difference between salary vs.

Management is willing to pay 10 of this revenue 100000 as total annual salesperson compensation. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. The business owner determines a set wage or amount of money for themselves and then cuts a paycheck for themselves every pay period.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. The bad news is that the dividend payment is not a tax-deductible expense. Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Money taken out of the business profits. When should you use one over the other.

Its a way for them to pay themselves instead of taking a salary. Annual base salaries range from 40000 to 60000 based upon salesperson experience and need. If you draw 30000 then your owners equity goes down to 45000.

Up to 32 cash back If a C-corp business owner wants to draw money above his or her salary it must be taken as a dividend payment. There are two main ways to pay yourself. That means that an owner can take a draw from the business up to the amount of the owners investment in the business.

Before you can decide which method is best for you you need to understand the basics. When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every time you run payroll. Owners equity is made up of different funds including money youve invested into your business.

Draws can happen at regular intervals or when needed. First lets take a look at the difference between a salary and an owners draw. There are two main ways to pay yourself as a business owner owners draw and salary.

The balance of each salespersons compensation is commission. Owners draws can be scheduled at regular. Here is her partner equity balance after these transactions.

Keep in mind that a partner cant be paid a salary but a partner may be paid a guaranteed payment for services rendered to the partnership. As long as you keep your personal and business expenses separate ideally using separate bank accounts youre good. As we outline some of the details below.

With the draw method you can draw money from your business earning earnings as you see fit. Payroll income with taxes taken out. Business owners can withdraw profits earned by the company.

Average Salary Uk A Comprehensive Overview Payspective

Accounting Services Accountants London Online Accountants Uk Accounting Services Self Assessment Accounting

Uk Sales Survey Statistics Infographic Infographic Sales Recruitment Development

Average Salary Uk A Comprehensive Overview Payspective

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Return Income Tax

Explore Our Example Of Pay Stub Template For Truck Driver For Free Payroll Template Statement Template Business Template

Explore Our Sample Of Employee Payroll Change Form Template For Free Understanding Estimate Template Templates

Tower Crane Operator Salary In Us High Rise Crane Operator Salary Crane Operator Tower Occupational Health And Safety

Data Report Uk Founder Salaries Share Vesting Seedlegals

Average Salary Uk A Comprehensive Overview Payspective

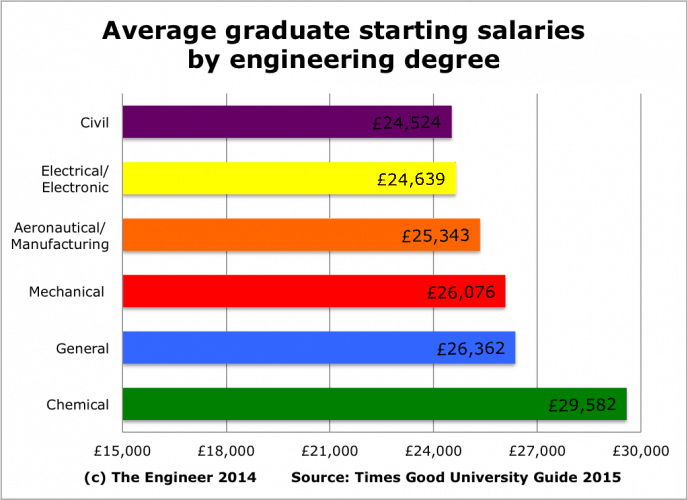

The Myth Of Engineering Low Pay

Swim Lane Process Mapping Diagram Payroll Process Payroll Small Business Entrepreneur Virtual Payroll Process Flow Chart Flow Chart Process Map